Paul B Insurance Medicare Health Advantage Huntington Things To Know Before You Get This

Table of ContentsThe Basic Principles Of Paul B Insurance Medicare Agent Huntington The smart Trick of Paul B Insurance Medicare Agent Huntington That Nobody is Talking About

Health insurance pay specifies sums for medical costs or treatment and they can use numerous alternatives and also vary in their methods to coverage. For aid with your particular issues, you may intend to speak with your employers advantages division, an independent professional consultant, or get in touch with MIDs Consumer Services Division. Getting health insurance is a really important decision (paul b insurance medicare insurance program huntington).

If you have a group wellness plan, a pre-existing condition is a wellness condition for which clinical recommendations, medical diagnosis, care or therapy was recommended or received within 6 months of joininga plan. If your health and wellness insurance firm has actually refused to pay for health treatment solutions that you have actually gotten or want to get, you have the right to know the specific legal, medical or other reason why. Sometimes, a doctor, medical facility, or other health and wellness treatment center leaves a taken care of care strategies network.

You must obtain this listing when you enlist, re-enroll, or upon request. Every managed care strategy should keep close track of the high quality of the health care services it gives. Taken care of treatment strategies need to not utilize benefits or charges that encourage much less treatment than is clinically essential. If you would like to know even more regarding exactly how your plan pays its carriers, you need to ask. The notice must include the major reasons for the rejection and also guidelines on just how to appeal. Every took care of treatment plan ought to comply with particular treatments if it figures out that a healthcare service was not medically needed, effective, reliable or suitable. The treatments must be totally described in the certification of coverage or participant handbook. You ought to make a listing of your requirements to contrast with

Paul B Insurance Insurance Agent For Medicare Huntington for Dummies

the benefits offered by a plan you are thinking about. You need to contrast plans to locate out why one is more affordable than one more. Listed here are some inquiries you should ask when looking for medical insurance: What does the plan pay for and also not pay for? Will the plan pay for preventative care, booster shots, well-baby care, drug abuse, body organ transplants, vision care, dental care, the inability to conceive treatment, or resilient clinical tools? Will the strategy spend for any prescriptions? If it pays for some, will it pay for all prescriptions? Does the strategy have psychological health benefits? Will the plan pay for long-term physical treatment? Not all plans cover every one of the benefits noted above. Do prices boost as you age? How usually can rates be altered? Just how much do you have to pay when you get health and wellness treatment services(co-payments as well as deductibles)? Exist any type of limits on just how much you must spend for health treatment services you receive(out of pocket optimums)? Exist any type of limitations on the variety of times you may receive a service(lifetime maximums or yearly benefit caps)? What are the restrictions on using suppliers or solutions under the strategy? Does the health insurance plan need you to.

see companies in their network? Does the health plan pay for you to see a doctor or make use of a hospital outside the network? Are the network suppliers easily situated? Is the physician you wish to see in the network accepting brand-new individuals? What do you need to do to see a professional? How very easy is it to obtain a consultation when you require one? Has the firm had an unusually high number of consumer issues? What takes place when you call the business customer complaint number? Just how long does it require to get to a genuine individual? Married couples in scenarios where both partners are supplied medical insurance through their jobs need to contrast the protection as well as costs(premiums, co-pays and also deductibles)to identify which policy is best for the household. Maintain all invoices for clinical solutions, whether in -or out-of-network (paul b insurance Medicare Advantage Agent huntington). In case you surpass your deductible, you may certify to take a tax reduction for out-of-pocket medical expenses. Take into consideration opening up a Flexible Spending Account (FSA ), if your employer provides one, which permits you to allot pre-tax dollars for out-of-pocket medical expenses. : that may not yet have a full time work that offers health and wellness advantages ought to be mindful that in an expanding number of states, solitary adult dependents may be able to continue to get health protection for a prolonged period( ranging from 25 to 30 years old)under their parents 'wellness insurance coverage plans also if they are no much longer complete time trainees. with kids ought to consider Flexible Spending Accounts if available to help spend for common childhood years clinical problems such as allergy examinations, braces as well as replacements for lost glasses, retainers and so forth, which are typically not covered by fundamental medical insurance

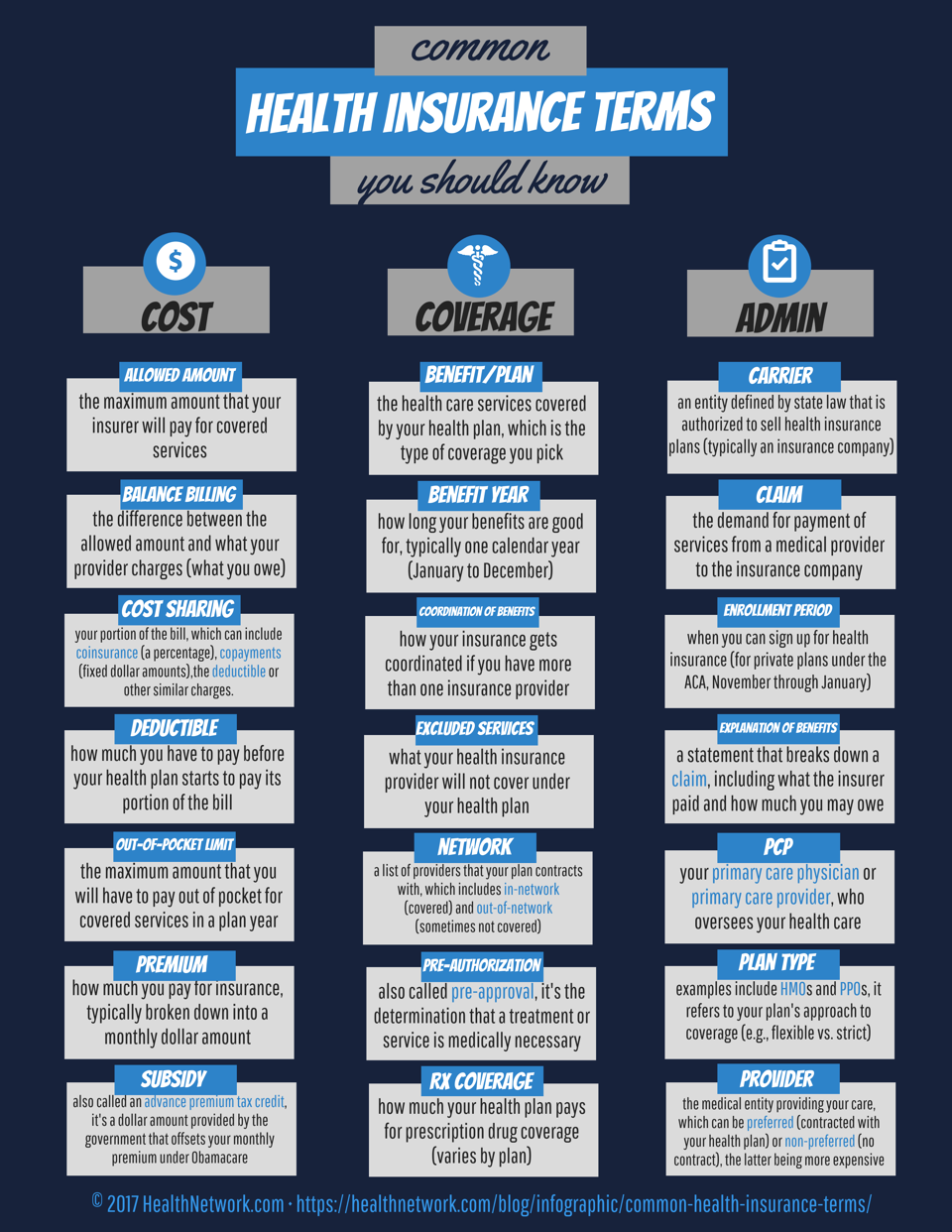

All workers that shed or change tasks ought to recognize their rights to continue their wellness coverage under COBRA for approximately 18 months. At this life phase, consumers may desire to assess whether they still require handicap insurance coverage. Several will wish to choose whether lasting care insurance makes good sense for them(e. g., will certainly they have the ability to pay for the premiumsinto seniority, when most require to use such insurance coverage). If we can be of help, please see the Demand Support Web Page for info on just how to contact us. Wellness insurance is important to have, yet it's not always understandable. You may need to avesis vision take a few steps to make sure your insurance will certainly spend for your health and wellness care expenses. There are additionally a great deal of crucial words and also expressions to keep straight in your head. Right here's some standard info Discover More you require to know: Medical insurance assists spend for your health care. It likewise covers lots of precautionary services to keep you healthy and balanced. You pay a monthly costs called a premium to acquire your health insurance policy and also you may need to pay a portion of the price of your treatment each time you obtain clinical services. Each insurer has different regulations for using health and wellness care advantages. Generally, you will offer your insurance infoto your medical professional or health center when you choose care. The doctor or medical facility will bill your insurance coverage firm for the services you obtain. Your insurance policy card proves that you have medical insurance. It has details that your physician or healthcare facility will certainly use to earn money by your insurance coverage firm. Your card is likewise helpful when you have inquiries concerning your health and wellness insurance coverage. There's a phone number on it you can call for information. It may likewise note basics concerning your health strategy and your co-pay for office brows through. Medical professionals and hospitals commonly contract with insurance policy companies to become part of view it the company's"network."The agreements spell out what they will certainly be paid for the treatment they supply. Some insurance intends will not pay anything if you do not make use of a network provider (other than in the instance of an emergency ). So it is very important to speak with the strategy's network before looking for care. You can call your insurance provider making use of the number on your insurance coverage card. The company will tell you the physicians as well as hospitals in your location that belong to their network.